Disappointing Jobless Claims Figures Show Little Progress, Gold Price Holds Steady

1.48 million Americans applied for unemployment benefits in the week ended June 20, almost matching the 1.54 million (upwardly revised) claims seen a week earlier. Claims were forecast at 1.32 million, but progress in the labor market recovery has been slower than expected. While claims figures have ticked downward for 12 consecutive weeks, analysts are concerned at the small gap between the last two weeks. In total, 47 million Americans have applied for jobless benefits in the last 14 weeks.

Key Takeaways

- Jobless claims for the week ended June 20 came in at 1.48 million vs. 1.32 million expected and 1.54 million the week before.

- Continuing claims came in at 19.52 million for the week ended June 13, down from 20.29 million cases the week before and lower than the 20 million expected.

- California reported the most claims with 287,000 new applications, gaining on 241,000 the week before.

Applications for Pandemic Unemployment Assistance (PUA) claims, which includes claims for people like contractors who were previously ineligible for unemployment insurance, ticked downwards. PUA claims totalled 728,120 in the week ended June 20 (unadjusted) vs. 770,920 claims reported the week before.

California saw the most new cases with 287,000 new claims in the week ended June 20, up from 241,000 the week before. Georgia reported 124,000 claims last week, down from 132,000 the week before. Florida saw 93,000 new claims, New York reported 90,000, and Texas reported 89,000. Despite rising coronavirus cases in some areas, many states have initiated a reopening of their economies. The initiative began in May for many states, with a gradual loosening of lockdown restrictions allowing certain businesses to open their doors.

#JoblessClaims Charts https://t.co/3qPWvTGT2I pic.twitter.com/KEL0XmsT4w

— Logan Mohtashami (@LoganMohtashami) June 25, 2020

The reopening has correlated with increased number of coronavirus cases. States with the highest spread of the virus are seeing the slowest economic activity. Arizona, Texas, and Utah are among the states with contracting economic activity. Out of 9.4 million cases and 483,000 COVID-19 deaths around the world, the US accounts for 2.3 million cases and 121,000 deaths.

Expert Outlook

Nomura economist Lewis Alexander said on Wednesday that “Initial jobless claims continue to moderate only gradually. While the labor market remains exceptionally weak, signs of gradual improvement suggest another month of NFP gains during June.”

“We’re seeing a slowdown in layoffs, but hiring hasn’t picked up a tremendous amount,” said Nick Bunker, economist at the job site Indeed. “The recovery from this is going to potentially be a very long slog if we can’t get the virus under control quickly.”

“There’s still this two tracks of this ongoing hemorrhaging of jobs while we also see a lot of people getting rehired,” said Heidi Shierholz, senior economist at the Economic Policy Institute.

Market Reaction

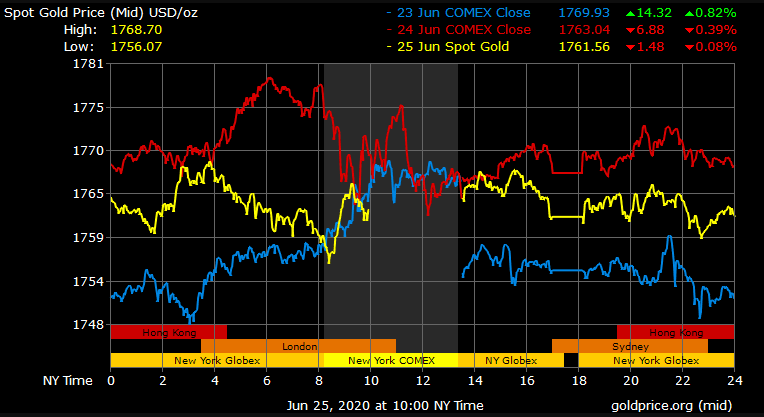

Gold prices have seen little reaction to the day’s news. Spot gold last traded at $1,761.56/oz, down 0.08% with a high of $1,768.80/oz and a low of $1,756.07/oz. Gold prices have seen low volatility in today’s session, with weaker than expected labor market news perhaps offset by the durable goods orders report for May, which beat expectations. Q1 GDP reportedly fell 5% according to the latest report, in line with market forecasts.