Conversion : 1 troy ounce = 31.1034768 grams

Could not show charts

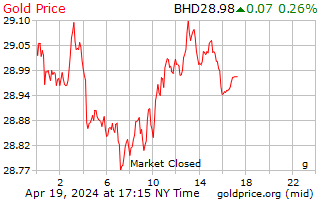

Gold Price Bahrain

Gold is a global commodity that is recognized, valued and traded all over the globe. If you are in Bahrain, you will likely see gold prices quoted in the local currency, the Bahraini Dinar. Gold may also be quoted in other key currencies as well, such as U.S. Dollars, euros or in Great British Pounds. The gold price is typically quoted in Bahrain as price per ounce, kilo, gram or 10 tolas bar. The most commonly used carats in Bahrain are 18, 22 and 24 carats, although 21 carat is also sometimes used.

Bahrain is officially known as the Kingdom of Bahrain. The nation is a small Arab constitutional monarchy located in the Persian Gulf. The country is an island, and it is situated between the Qatar Peninsula and the northeastern coast of Saudi Arabia. Bahrain is approximately 780 square kilometers in size, making it one of the smallest nations in Asia. Bahrain reportedly had the first post-oil economy in the Persian Gulf, and the nation has recently invested heavily in the banking and tourism sectors. Manama is the country’s capital, and many large financial institutions now have a presence in the capital.

In 2008, Bahrain was reportedly named the world’s fastest growing financial center by the City of London’s Global Financial Centres Index. The nation’s financial services and banking sectors have seen strong growth on the back of the oil boom. Petroleum products and processing represent a significant piece of the nation’s exports, accounting for over half of its exports and government revenues.

The country’s dinar can be divided into 1000 fils. The currency was introduced in 1965 and replaced the Gulf Rupee. The Bahrain Dinar is controlled by the Central Bank of Bahrain.

Whether in Bahrain or elsewhere, investors amy seek to buy and hold physical gold for the numerous potential benefits it may offer. Gold not only has the potential for price appreciation, but it also may potentially provide a hedge against numerous economic and geopolitical issues such as inflation, weakening paper currency values and more.

Gold bullion can be purchased in either coin or ingot form, and comes in many different designs and weights. Investors on a budget or collectors may be more likely to chose gold bullion coins, while larger investors may be more likely to choose larger gold bars. Bars may potentially offer investors the lowest per-ounce premiums, as they are relatively less expensive for fabricators to produce.

There are two types of gold bars to choose from: Minted bars and cast bars. Minted bars have a sleek and shiny finish while cast bars have a dull, aged look. Cast bars are produced by pouring liquid gold into molds and allowing the metal to cool. Because of the way they are made, no two cast bars are exactly the same. Cast bars may potentially offer an even greater cost savings when compared to minted ingots, as they are one of the least costly to produce and refiners may pass those cost savings on in the form of lower premiums.