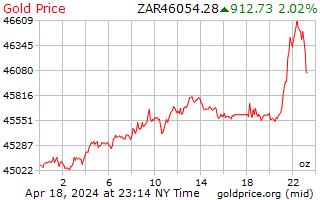

Gold Price per Ounce

Conversion : 1 troy ounce = 31.1034768 grams

To learn about our gold price data

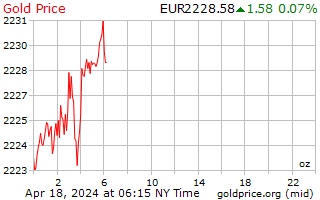

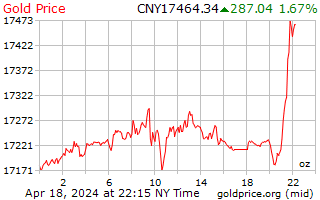

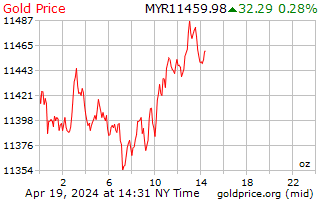

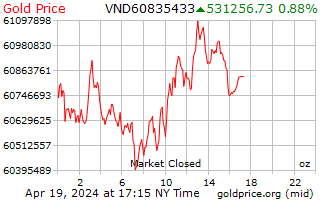

On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can, however, be quoted in any currency by the ounce, gram or kilo. The price of gold is constantly on the move and can be affected by many different factors.

Is the Gold Price the Same as the Spot Price?

When looking at gold prices, the figures quoted are typically going to be spot gold prices unless otherwise specified. The spot gold price refers to the price of gold for delivery right now as opposed to some date in the future. Spot gold prices are derived from exchange-traded futures contracts such as those that trade on the COMEX Exchange. The nearest month contract with the most trading volume is used to determine the spot gold price.

Why do Investors Care About the Gold Price?

As with any other type of investment, those looking to buy gold want to get the best deal possible, which means buying gold at the lowest price possible. By watching gold prices, investors can look for trends in the gold market and also look for areas of support to buy at or areas of resistance to sell at. Because gold pretty much trades around the clock, the gold price is always updating and can even be viewed in real time.

Why are Gold Prices Always Fluctuating?

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Monetary policy

- Interest rates

- Currency market activity

- Inflation/deflation

- Geopolitics

- Risk appetite or aversion

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

Monetary policy can also affect the gold price. If a government is actively engaged in quantitative easing or other stimulus programs, those programs may potentially weaken the country’s currency, possibly making gold more attractive. In addition, such QE programs also add to sovereign debt levels, potentially also making hard assets like gold more attractive.

Is the Live Gold Price Just for the U.S.?

Gold is traded all over the globe, and is most often transacted in U.S. Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the U.S. or Asia.

The price of gold is available around the clock, and trading essentially never ceases. While investors in the U.S. are sound asleep, for example, gold trading in Asian markets may be robust. The market is very transparent, and live gold prices allow investors to stay on top of any significant shifts in price.

The current gold price can be readily found in newspapers and online. Although prices per ounce in dollars are typically used, you can also easily access the gold price in alternative currencies and alternative weights. Smaller investors, for example, may be more interested in the price of gold per gram than ounces or kilos. Larger investors who intend to buy in bulk will likely be more interested in the gold price per ounce or kilo. Whatever the case may be, live gold prices have never been more readily accessible, giving investors the information they need to make buying and selling decisions.