Gold Price Recap: April 18 - April 22

Happy Friday, traders. Welcome to our weekly market wrap, where we take a look back at these last five trading days with a focus on the market news, economic data and headlines that had the most impact on gold prices and other key correlated assets—and may continue to into the future.

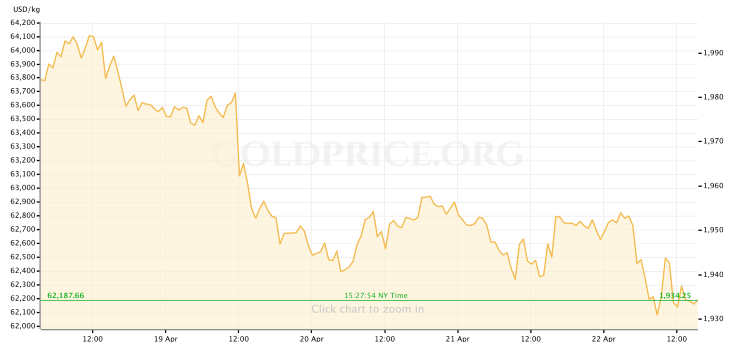

What could we say that the chart doesn’t? After a few promising ticks higher on Monday, gold longs are probably very happy to be dropping the curtain on what’s been one of the most price-destructive weeks for gold in months.

So, what kind of week has it been?

“Brutal” is not a fun word to use in describing the week that is, mercifully, finally closing for the gold market; but it’s also not inaccurate. With little in the way of true directional input from either headlines or from macroeconomic data—an issue that most asset classes, not just gold, reckoned with this week—gold’s resistance to strength from its traditional opposition finally gave way and pulled the spot price away from what looked like a promising opportunity to move towards $2000/oz again.

It was an uneven start to the week for most major assets on Monday, and US markets opened in a stress position created by quickly running-and-rising Treasury yields: the 10-year note had already climbed and held firm above 2.85%, nearly 10 basis points higher than last week. Gold for weeks has remained resilient in the face of these higher interest rates, but it seemed that the pace and peak of Monday’s move in yields finally snapped high-priced support for the yellow metal and spot began falling from a promising perch above $1990/oz to the neighborhood of $1975.

The somewhat quiet driver of the week in markets has been investors and managers’ worry about inflation in the months ahead; although the concerns about decades-high inflation have stopped mounting for now, they remain very present in the psyche of the marketplace. Indeed, it’s being taken as given in the week’s coverage of financial markets that while rising bond yields can often be driven by investors’ positive view of the medium- to long-term health of the market, in this case the tailwind is a more negative sense of stress around how long inflation will remain where it is. We’ve suspected that, in recent weeks, that this concern and uncertainty was enough to keep gold aloft as an important safe haven trade, enough to buffer prices higher despite the fact that gold usually weakens its position in higher-rate environments; but it’s clear that the move in the 10-year yield towards 3% (which has persisted since Monday) has finally been enough to drawdown investors’ interest in gold as an asset, no matter the underlying predictions driving the move.

The US marketplace was decidedly more positive on Tuesday, as investors seemed to better-digest the elevated level of bond yields. All three major US stock indexes made solid gains on the day, led by a resurgence in the play for tech/growth stocks. (That Tuesday’s rally was so heavily composed of a rally in the tech sector would come back to bite markets, of course.) With the benchmark 10-year yield moving above 2.9%. The markets on Tuesday appeared to have returned to the stance of acknowledging the persistent risk posed by high inflation, but buying in to the outlook that the labor market and other macro developments allow the Fed room to act aggressively against it.

The briefest glance at gold’s chart this week would tell you that this—a sharp improvement in risk sentiment, timed with the benchmark Treasury yield continuing to climb—came at a particularly bad time to for already woozy gold bulls. Through the first hours of trading in New York on Tuesday, gold spot prices collapsed by more than $20/oz en route to a flat road at $1950 for the session as bond yields reached their highs of the week.

The momentum generated by investors jumping back into the tech sector on Tuesday was slammed into reverse after the bell, when Netflix released a quarterly report that announced the first contraction in its subscriber base in more than 10 years. Once trading re-opened on Wednesday morning, Netflix’ stock went into a free-fall that would total up to a loss of $50 billion in market cap (a 35% slide on the session.) The gravity of one of the vaunted FAANG stocks of the “new economy” falling so sharply absolutely ruined investors’ mood for the remainder of the week. The sudden jump back into risk aversion benefited gold’s performance somewhat on the day, but only enough to keep things level with no real signs of a rally.

The remaining two trading days of the week (for gold and other USD-tied assets) have been all about (once again) the Fed—but, this time, also the Dollar itself. Investors turned on Thursday (as equities again slid slower across the US stock markets) to the final marquee appearance from Fed Chair Jerome Powell, who took the stage as part of the annual IMF meeting in Washington DC. While Powell’s comments were mostly a reiteration of what we’ve heard from the Chair and other important members since March—that is, that a +0.50% hike is just around the bend-- It’s more than possible that Powell’s remarks will continue to be parsed further this afternoon and into Friday, for clues about the FOMC’s next steps and its appetite for monetary tightening through the rest of this year; the reporting on which could have an impact on virtually every piece we’ve touched on this week: stocks, gold, the Dollar—certainly rates.

And the Dollar has certainly already benefited from the Fed’s most recent and upcoming policy plans. As yields remain near recent highs with the 10Y eyeing 3%, the US Dollar has also returned to highest levels in 2 years, growing in value against its most common trading partners thanks to higher rates and the Fed’s path for more tightening. Should the Greenback return to and remain in the position of “King Dollar” once again, it could pose a threat to stock market’s upside as a very strong Dollar is always pointed to as a negative pressure in quarterly earnings reports even as it does aid to balance-out inflation’s upside. (It’s worth noting, this being earnings season, that we’re not yet hearing CEOs and boards pointing to the risk or resistance created by a super strong Dollar, but should Q2 earnings pale in comparison we can expect commentary around USD to become more volatile.)

Regardless of when the Dollar might start to further slow the US stock market, it Is almost a certainty that the bull-running Dollar and higher rates are working in tandem and in a feedback loop to apply the tremendous pressure on gold prices this week, which at Friday’s end we see lowering gold spot prices to recent support at $1935/oz. Even though many major commodities have had a positive week (gold market seems to have finally cracked somewhat under the pressure of the Dollar’s surge while bond yields remain drawn to recent highs and higher, and the Fed has all but promised to extend and accelerate that move.

For next week, we’re looking at an even more quiet calendar than this week’s, if you can believe it. True enough, we’ll get a report on the Fed’s measurement of inflation in the US economy, but there shouldn’t be much there than CPI and the like haven’t shown us already. And with the FOMC entering a blackout period ahead of the May meeting, rates-sensitive assets like gold will be left at the mercy of investors and pundits trying to dial in their expectations for the next hike; and all while markets are again likely to be turned to-and-fro by headlines around the war in Ukraine and its reverberations through the global financial system.

For now, traders, I hope you can get out and safely enjoy your weekend for the next couple of days. After that, I’ll see everyone back here on Monday for our preview of the week ahead.